Mixed 3rd quarter performance for satellite manufacturers

The continued expansion of internet and communications industries has led to the continued growth of the satellite industry. However, profits have not remained consistent. This quarter, satellite manufacturers’ profits have been largely mixed. These companies have identified lower order volumes as a primary reason for their lower bottom line.

The industry entering 2017

The annual report published by the Satellite Industry Association provided clear indications for growth in the industry. The number of satellites in orbit has grown 50% in a span of five years. At the end of 2016, there were already 1,450 satellites in orbit.

According to the report, growth within the satellite industry has been continuous over the years. In 2016, the industry grew 261 billion USD. Though in terms of percentage, this was only a 2% growth over 2015’s 255 billion USD growth.

It is safe to say that the industry is continually growing, however, at a slower pace. This quarter’s mixed performance by large satellite manufacturers is an indication of the slowdown identified in last year’s report.

3rd quarter satellite manufacturer performance

Thales

This year has not been very kind to Thales Group. Their performance for the first three quarters has been evidently weak. The value of their Aerospace Division dropped by 18% to 3.5 billion USD. This is despite the fact that their sales performance did see an uptick, with a 4.4% increase. The sales increase was brought about by a contract with Immarsat for a Very High Throughput Satellite (VHTS). Also contributory to the increase in sales is a telecommunications satellite contract for an undisclosed client.

According to Thales, “Sales of tubes and imaging systems remained impacted by the weakening global satellite market.”

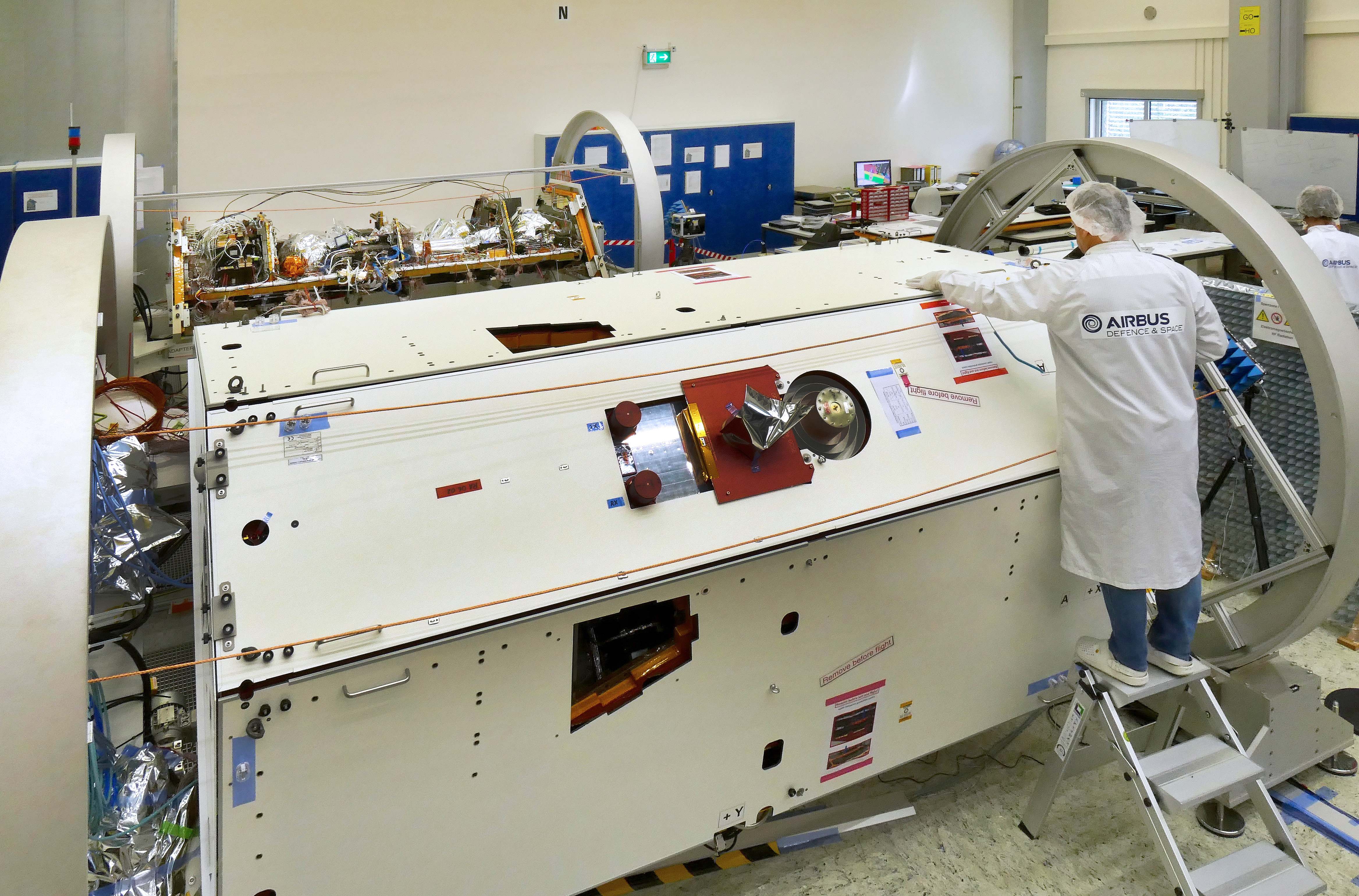

Airbus

The European, multinational Airbus has notably clocked in a 2.4% revenue growth valued at 16.4 billion USD over the same time period in 2016. This growth, however, was credited largely to the performance of its commercial aircraft division. Airbus Defense and Space, on the other hand, experienced a decrease in revenue. The company made 2.4 billion USD as against the 2.5 billion USD it made over the same period last year.

Airbus officials identified a sluggish telecommunications market as a reason for the dip in revenue.

Boeing

Boeing’s performance is similar to Airbus. Its commercial airline business has experienced a boom. The company was able to deliver a record 202 commercial planes during the 3rd quarter. However, its defense, space, and security division experienced a 5% drop in revenue. Their largest contract in the satellite industry over this period is the construction of Medium Earth Orbit satellites for SES

Orbital ATK

Among the large satellite manufacturers, Orbital ATK has generated the most revenue. The company’s performance netted a 1.2 billion USD in revenue. This is 16.5% higher than their performance over the same period in 2016. Their stellar performance has been attributed to all company segments performing well.

Orbital ATK’s space systems group reported revenue reaching 314 million USD. This is a 26% increase in year-on-year performance.

Also noteworthy is Northrop Grumman’s announcement of their planned purchase of Orbital ATK. The purchase is to be made at a value of 9.2 billion USD.